bradford tax institute cost

Bradford County Tax Collectors office PO. Subscription Services 1050 Northgate Dr Ste.

Individual Income Tax The Basics And New Changes

Well explain the importance of Revenue Ruling 70-393.

. Suite B Starke FL 32091-0969. Bradford Tax Institute Blog. Thats why I created my manual Business Tax Deductions for one-owner and spouse-owned businesses proprietorships S corporation C corporations limited liability companies 1099 and statutory employees.

Log in to view full article. My name is Murray Bradford CPA. In 1979 I began developing tax strategies for the self-employed and one-owner businesses.

Heres a resource guide that gives you the Tax Cuts and Jobs Act tax reform articles published at the Bradford Tax Institute from January 1 through July 31 2018 including for each article the a topic b code section c prior law d new law and e link. Would you like help resolving a dispute against Bradford Tax Institute. 1701 Pennsylvania Avenue NW Suite 300 Washington DC 20006 E-Mail.

351 San Rafael CA 94903 Telephone. Is the market leader and expert in tax reduction seminars and products for the self-employed business owners. World-Class Bradford Tax Institute.

Bradford Tax Institute Blog. We provide quality Health Care Training Programs and we specialize in producing top notch qualified practitioners in the following fields. Branford Institute founded in June 2004 is a leading Vocational School in the State of New Jersey.

Murray Bradford in 1991. Subscription Services 1050 Northgate Dr Ste. Since 1989 Bradford and Company has found billions of dollars in new deductions and.

Bradford Tax Institute Subscription Services 1050 Northgate Dr Ste. Bradford is the nations pre-eminent tax reduction expert having found an average of 17700 in new tax deductions for over 500000 and counting small businesses and self-employed professionals. The median cost in 2018 for a year in an assisted living facility was 48000 and over 100000 for nursing home care.

Schedule Your Free Inspection Now Get Your Bradford Tax Institute Services Now. To soften the financial blow you can take advantage of tax code rules that let you deduct assisted living and nursing home costs on your tax return. Ad Special Latest Deals On Premium Services.

The Tax Reduction Letter is published by the Bradford Tax Institute which was founded by W. PeopleClaim provides free and low-cost dispute resolution services for consumers employees patients and anyone else whos been treated unfairly. Bradford Tax Institute Subscription Services 1050 Northgate Dr Ste.

Log in to view full article. Learn how the Bradford Tax Institute can help you as a tax professional help your one-owner clients pocket more after-tax. For example if your Medicare cost without penalty is 5000 your penalty is 1000 and your cost for the year is 6000.

1050 Northgate Drive Suite 351 San Rafael CA 94903 E-Mail. How Cost Segregation Can Turn Your Rental into a Cash Cow. To see how much this health care is going to cost and to identify.

1050 Northgate Drive Suite 351 San Rafael CA 94903 E-Mail. Traffic rank provides an estimate of the websites popularity by comparing level of visitors that visited the site every month to other sites around the world. Three ways our fact-filled article can help you.

Bradford and Company Inc. After 90 days refunds are offered on a pro-rated basis. 351 San Rafael CA 94903 Telephone.

Bradford Tax Institute Blog. 1701 Pennsylvania Avenue NW Suite 300 Washington DC 20006 E-Mail. We have two Campuses located in Elizabeth and Paterson.

List 2021 and 2022 Medicare health insurance premium amounts. The ruling states that the monies spent to outfit and support your team are similar to monies spent on other methods of advertising. Best of all hosting of a Bradford Tax Seminar wont cost youor your peoplea penny.

1050 Northgate Drive Suite 351 San Rafael CA 94903 E-Mail. 1050 Northgate Drive Suite 351 San Rafael CA 94903 E-Mail. Bradford Tax Institute Blog.

This means you can deduct those sports teams costs as business expenses for federal income tax purposes. PeopleClaim is a new way to resolve disputes online and at a fraction of the cost of mediation arbitration litigation and. For the next year if your Medicare cost is 6000 your penalty is 1200 and your cost for the year is 7200.

1701 Pennsylvania Avenue NW Suite 300 Washington DC 20006 E-Mail. Explain why decisions you make on your yet-to-be-filed 2021 Form 1040 will determine your premiums for 2023 less than 11 months from now Explain the ins and outs of Medicare Advantage Medicare Part C you can use to cut your increasingly high premium costs. 351 San Rafael CA 94903 Telephone.

Box 969 945 North Temple Ave. The tax reduction letter is published by the bradford tax institute which was founded by w. I emailed about 3 times with a ton of questions and i cant say just how thorough they were with.

The OBR said inflation combined with rising taxes will weigh heavily on living standards in the coming 12 months. 351 San Rafael CA 94903 Telephone. PA Graphics Despite a 6.

If the answer is yes you can deduct the cost of your direct-route transportation getting you to and from your foreign business destination. 1701 Pennsylvania Avenue NW Suite 300 Washington DC 20006 E-Mail.

The 651 958 00 Email Series Membership And Subscription Growth

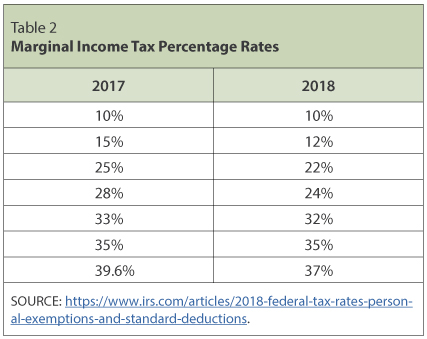

Individual Income Tax The Basics And New Changes

Tax Reduction Letter Tax Smart Solutions For The Self Employed

Tax Course Bradford And Company

Pdf International Corporate Tax Avoidance A Review Of The Channels Magnitudes And Blind Spots International Corporate Tax Avoidance A Review

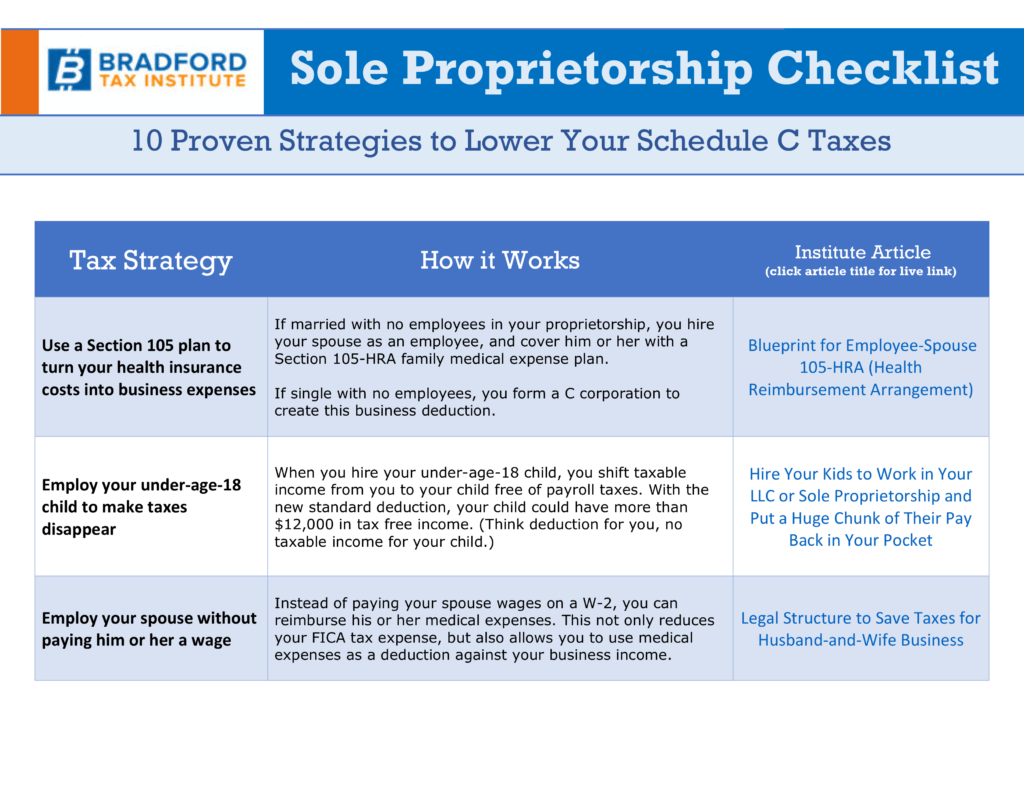

Free Checklist 10 Proven Tax Reduction Strategies For Sole Proprietors